The world of work is undergoing a significant transformation. The COVID-19 pandemic accelerated the shift towards remote work, with a staggering 42% of the global workforce reporting they now work remotely at least some of the time according to a FlexJobs survey.

This trend is expected to continue, with businesses increasingly embracing remote work models to attract top talent and enhance employee satisfaction.

However, managing a geographically dispersed workforce comes with its own set of challenges. One of the most significant hurdles is navigating the complexities of global payroll.

Traditional payroll systems are often designed for domestic employees and struggle to handle the intricacies of international tax and labor laws.

Here’s why global payroll can be a nightmare for businesses:

- Varying tax regulations: Each country has its own set of tax withholding rules, social security contributions, and other payroll requirements. Keeping up-to-date with these regulations can be a daunting task for businesses, especially those with employees in multiple countries.

- Administrative burden: Manually processing payroll for an international workforce is incredibly time-consuming and prone to errors. Businesses need to calculate salaries, withhold taxes, and generate payslips for each employee, all while complying with local regulations.

- Hidden costs and fees: Traditional payroll providers often charge hidden fees for international money transfers, currency conversions, and other services. These fees can significantly erode a company’s profit margins.

- Limited scalability: Traditional payroll systems may not be scalable enough to accommodate a growing or fluctuating workforce. Businesses with a remote workforce that frequently hires contractors or freelancers may find their existing system inadequate.

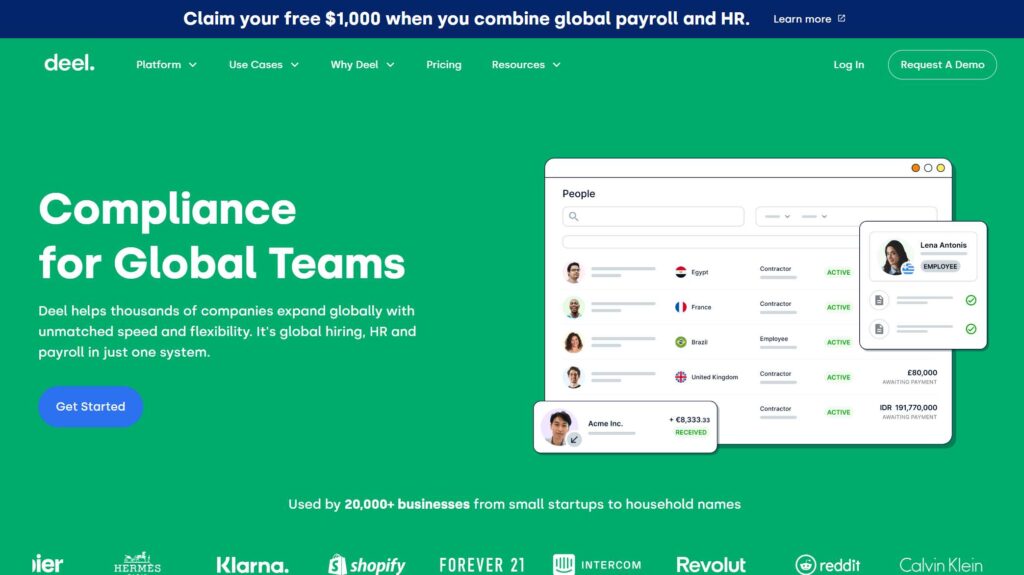

This is where Deel comes in. Deel is a global payroll and compliance solution designed to simplify the process of paying employees around the world. By leveraging Deel’s platform, businesses can overcome the challenges of global payroll and focus on what matters most – growing their business.

The Pain Points of Traditional Global Payroll

Imagine juggling payroll for a team scattered across different continents. Each location has its own set of tax regulations, social security contributions, and labor laws.

Keeping compliant feels like navigating a bureaucratic maze, filled with paperwork, deadlines, and the constant threat of hefty fines.

Unfortunately, this is the reality for many businesses struggling with traditional global payroll.

Let’s break down the key pain points of traditional global payroll:

- Complexity of International Tax and Labor Laws: “International tax and labor laws can be incredibly complex, with significant variations from country to country,” says Sarah Jones, a global HR consultant. “Even minor mistakes can lead to hefty penalties and reputational damage.” Businesses need to stay updated on withholding tax rates, social security contributions, and other regulations that can change frequently. This requires a dedicated team or outsourcing to specialists, adding significant cost.

- Time-consuming Administration: Manually processing payroll for an international team is a tedious and error-prone task. Each employee requires individual calculations for salary, tax deductions, and benefit contributions, all while following specific country formats for pay slips. A study by the National Payroll Processing Association (NPPA) found that businesses spend an average of 8% of their payroll budget on administrative tasks. This valuable time could be better spent on core business activities.

- Hidden Costs and Fees: Traditional payroll providers often charge a myriad of hidden fees that quickly erode your profit margins. These fees can include international money transfer charges, currency conversion costs, and additional service fees for compliance management. The lack of transparency in pricing makes it difficult for businesses to accurately budget for global payroll expenses.

- Limited Scalability: Traditional payroll systems are often designed for a static workforce within a single country. Businesses with a growing remote workforce or those frequently hiring freelancers may find their existing system inadequate. Scaling up a traditional system often requires additional software or personnel, adding further complexity and cost.

How Deel Streamlines Global Payroll and Compliance

Deel offers a comprehensive solution that tackles the complexities of global payroll head-on. Let’s dive into how Deel simplifies the process for businesses:

- Global Payroll Platform: Deel provides a user-friendly platform that allows you to manage payroll for employees in over 150 countries from a single dashboard. You can easily onboard new hires, set salaries and benefits, and generate payslips – all while ensuring compliance with local regulations. Deel automates many of the tedious tasks associated with payroll, freeing up your team’s time to focus on other strategic initiatives.

- Automated Compliance: One of Deel’s biggest advantages is its automated compliance features. Deel takes care of calculating and withholding taxes, social security contributions, and other mandatory deductions based on the employee’s location. This eliminates the risk of non-compliance penalties and ensures your business stays on the right side of local regulations.

- Flexibility for All Employment Models: Deel caters to a diverse workforce. Whether you have full-time employees, contractors, freelancers, or temporary workers, Deel can handle their payroll seamlessly. This flexibility is crucial for businesses with a remote workforce that utilizes various employment models.

- Cost-Effectiveness and Transparency: Deel offers a transparent pricing structure with no hidden fees. You’ll know exactly how much you’ll be paying for each employee, upfront.

Additionally, Deel eliminates the need for expensive international money transfers and currency conversion charges, leading to significant cost savings compared to traditional payroll providers.

By leveraging Deel’s platform, businesses can significantly reduce the administrative burden of global payroll, ensure compliance with local regulations, and save time and money.

Additional Benefits of Using Deel

Beyond streamlining payroll and compliance, Deel offers a range of additional benefits that enhance the overall experience for both businesses and their global workforce.

- Improved Employee Experience: Deel simplifies the payment process for employees, leading to increased satisfaction and loyalty. Employees receive their salaries on time and in their preferred currency, eliminating the hassle of dealing with international bank transfers and currency fluctuations. Deel also provides a user-friendly portal where employees can access their payslips, tax documents, and other important information.

- Enhanced Data Security: Data security is a critical concern for businesses, especially when dealing with sensitive employee information. Deel takes data security seriously and employs robust security measures to protect your company’s and your employees’ data. This includes industry-standard encryption protocols, access controls, and regular security audits.

- Streamlined Reporting and Analytics: Deel provides comprehensive reporting and analytics tools that offer valuable insights into your global workforce costs. You can easily track payroll expenses by country, employee type, and department. This data can be used to identify cost-saving opportunities and make informed decisions about your global workforce strategy.

In addition to the benefits mentioned above, Deel also offers:

- Multilingual support: Deel provides customer support in multiple languages, ensuring you can get assistance regardless of your location.

- Seamless integrations: Deel integrates with popular HR and accounting software, making it easy to manage your global workforce in one centralized location.

- Scalability: Deel can seamlessly scale with your business, regardless of how your global workforce grows or changes.

By utilizing Deel’s comprehensive suite of features, businesses can create a smooth and efficient experience for their global workforce, fostering a more engaged and productive team.

Getting Started with Deel

Ready to experience the benefits of Deel firsthand? Here’s a quick guide to get you started:

- Visit the Deel website: Head over to Deel website and explore the platform.

- Sign Up for a Free Trial: Deel offers a free trial that allows you to test drive the platform and explore its features. This is a great way to see if Deel is the right fit for your business.

- Create Your Account: Sign up for a Deel account by providing your basic business information and contact details. The signup process is quick and easy.

- Onboard Your Team: Once your account is set up, you can begin onboarding your employees. Deel provides a user-friendly interface for adding new team members, setting their salaries and benefits, and selecting their preferred payment method.

- Run Your First Payroll: Deel automates most of the payroll process, making it simple to run your first payroll for your global team. You can easily approve payments and ensure timely delivery to your employees.

Deel also offers a wealth of resources to help you get started, including:

- Comprehensive knowledge base: The Deel knowledge base provides detailed articles and tutorials on various topics related to the platform and global payroll.

- Video tutorials: Deel offers a library of video tutorials that walk you through the different features and functionalities of the platform.

- Customer support: Deel’s dedicated customer support team is available to answer any questions you may have about the platform or global payroll in general.

By following these simple steps and leveraging Deel’s resources, you can be up and running with a streamlined global payroll solution in no time.

Ready to simplify your global payroll and empower your remote workforce? Sign up for a free Deel trial today!